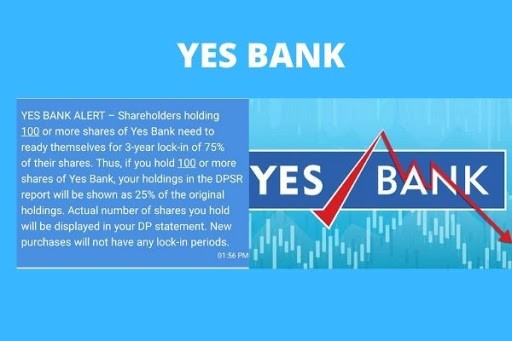

The final reconstruction scheme for Yes Bank notified by the government on 13 March has locked in existing shareholders for a period of three years up to 75% of their shareholding. Only those shareholders who have less than 100 shares in the bank, can sell their entire shareholding.

The caveat means anyone who has more than Rs 2,555 invested in the lender — an amount based on Friday’s price. YES Bank issued a statement advising investors holding more than 100 shares to “exercise utmost caution” while trading.

Read – LIC earns over Rs 14,000 crore profit from stock markets

Yes Bank has a 0.21% weight in the Nifty and will exit the Index on 27 March. According to data from Rupeevest as of 29 Feb, 72 funds held around 14 crore shares in Yes Bank.