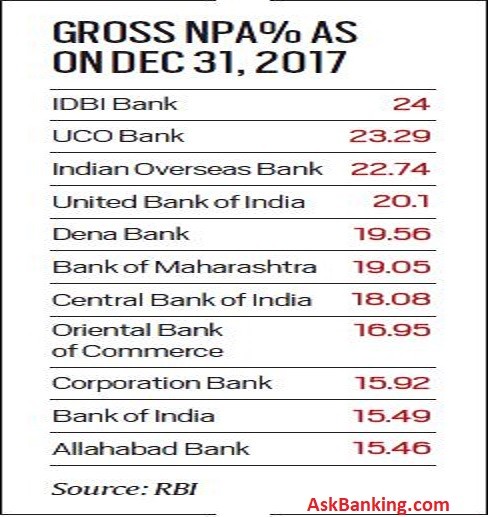

Reserve Bank of India (RBI) has listed out the 11 Public sector banks on their watchlist and monitoring their performances. According to central bank, these 11 weak PSBs out of the 21 State-owned banks are under the PCA, which kicks in when banks breach regulatory norms on issues such as minimum capital, amount of non-performing assets and return on assets.

These 11 banks are IDBI Bank, Bank of India, UCO Bank, Central Bank of India, Indian Overseas Bank, Oriental Bank of Commerce, Dena Bank, Bank of Maharashtra, United Bank of India, Corporation Bank and Allahabad Bank.

What is Prompt Correction Action (PCA) ?

Once any of banks fall under PCA, it means such banks are not allowed to renew or accept costly deposits or take steps to increase their fee-based income.

Banks needs to check the existing Non Performing Assets (NPA) and speedy drive to further addition of any fresh NPAs. Banks are not allowed to enter in any new ventures or new lines of business. RBI will also impose restrictions on the bank on borrowings from inter-bank market.

It may take these banks at least another 6-9 months before they report any noticeable improvement in the key regulatory indicators, which will help them come out of PCA.