State Bank of India (SBI) has introduced the cash transaction charges for depositing and withdrawing the money from the account after the free transaction limit provided to each type of account.

SBI will deduct the charges starting April 1. There will be Rs 50 charge for people carrying out over three cash transactions at its branch within a month. There is no upper limit for Cash Transaction.

Read : How To Do IMPS Fund Transfer in SBI

SBI Provides 10 free withdrawal from ATM in a month.

SBI is also charging for non maintenance of stipulated minimum balance in account. SBI will be charging defaulters a penalty from April 1 onward.

Read : Cash Transaction Charges on Withdrawal or Deposit

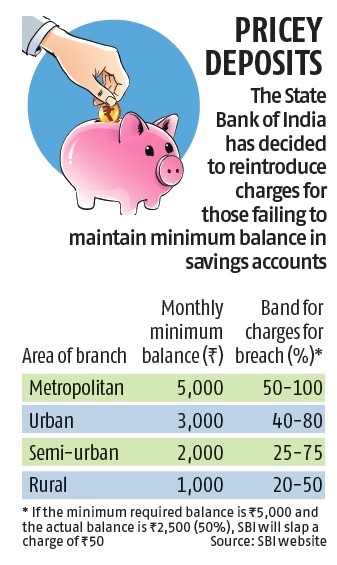

As per the categorization of area, charges will be levied like maintenance of Rs 5,000 mandatory for accounts in metropolitan areas, Rs 3,000 in urban areas, Rs 2,000 in semi-urban areas and Rs 1,000 in rural areas.

These charges will be based on the difference between the minimum balance required and the shortfall.

[box type=”info” align=”aligncenter” ]For metropolitan areas, if the shortfall is greater than 75 per cent. the charges would be Rs 100 plus service tax.[/box]

If the shortfall is between 50-75 per cent, the bank would charge Rs 75 plus service tax and for below 50 per cent shortfall, a fee of Rs 50 plus service tax would be levied.

In rural areas, the penalty for non-maintenance of minimum balance ranges from Rs 20-50 plus service tax.