Rupay Card registration for Online shopping and payment for various bank debit cum ATM card i.e. SBI , PNB, Syndicate, OBC, HDFC, Axis, ICICI, BOI, Bank of Baroda etc. Rupay is the reply to Mastercard and VISA through Make in India initiative by Government of India via National Payments Corporation of India (NPCI) for E-commerce solution including online shopping, purchasing, Mobile recharge and payment through ATM.

Financial transaction within India through Rupay enabled card costs less as compare to their peers i.e. VISA, Mastero etc. Rupay transaction cost is much lower and can be used freely at any merchant establishment within India.

Rupay is controlled and managed by National Payments Corporation of India (NPCI) which enables RuPay cardholders to transact online. NPCI provides platform to various banks in India for online transactions via mobile payment gateway RuPay PaySecure, which is almost linked with all banks in country.

Read : How To Register for IMPS for Any Bank in India ?

RuPay pay secure e-commerce transaction experience is most hassle free where transaction are done through card details and a One Time Password (OTP) only. Rupay doesn’t need any separate registration for online payment. Account and card holders of all banks in India i.e. SBI, PNB, Syndicate Bank, Bank of India, Bank of Baroda, ICICI bank, HDFC bank, Kotak Bank, Axis Bank etc may use it online without any separate registration for shopping and purchases. Rupay card also successfully used for mobile recharge payment or e wallet i.e. Paytm, easyrecharge,Ola cabs, Uber etc.

How to use Rupay card for first time online payment or transaction?

In order to use the Rupay card for Online transaction or shopping or online mobile recharge , Rupay Cardholder of any bank requires to register his RuPay card for enabling it for eCommerce while making the first transaction online.

Cardholder may follow the below mentioned steps in order to enable their card for online payments. In order to register the card, customer needs to purchase anything online through any of the online e commerce portal like flipkart, amazon, paytm, snapdeal etc.

After selecting the purchased item in shopping cart, go for the payment option page and choose the option Rupay Debit/ Credit card as payment option and follow the below steps.

1. On the payment screen select Rupay card as payment option.

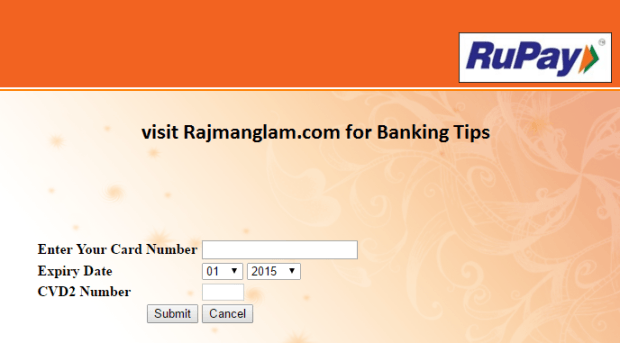

2. Provide RuPay card details on the payment screen viz card number, expiry date and CVD2 (3digits on back of the card).

3. Immediately an OTP (One Time Password) will be sent to the cardholder’s mobile number/email ID registered with the bank on particular card. (If OTP doesn’t received, your card doesn’t have had same mobile number registered. Contact bank branch to register your mobile number)

Read : How To Register Mobile Banking/Phone number with your bank

4. Once OTP received on mobile, Customer has to enter same OTP (One Time Password) received on his mobile number/email ID registered at the payment page.

5. A new image will be appeared after providing the correct OTP details. Customer has to select any one image from a small frame where random mix of images appears.Cardholder must remember selected image as it appears in future all payment made through this card.

7. Cardholder also asked to provide a phrase up to 35-40 characters. This phrase also to be remembered as the same will appear for identification in future transactions.

8. Cardholder needs to provide the correct ATM PIN.

9. After providing correct ATM pin, a message appears showing transaction as successful. Each bank have had their own paysecure services where the mode of registration may vary as with many bank while regiatration RuPay Premium PaySecure Service, a pop-up window appears on your computer screen and registration happens during the transaction itself.

Read : What is Unified Payment Interface ?

How To Make Online Payment after RuPay card registration ?

After registration of Rupay card successfully, customer may make payment subsequently using card details such as card number, expiry date and CVD.

Additionally the Cardholder will have to identify the correct image as selected while registration and customer have had to enter the ‘phrase’ that was entered during registration process Enter PIN to complete the transaction.

Mubarak