Debt to Equity Ratio Formula For Banks and calculator to know the ideal debt to equity ratio for granting loan or working capital to business. Calculate the basic formula for calculating debt to equity ratio of any firm or companies and use it in excel. This is also helpful in knowing the Negative debt to-equity ratio.

What is debt?

Debt is borrowed money from banks or private lender. The bank agrees to lend funds to the borrower upon a promise to pay back the money along with interest on the debt within a fixed repayment period through EMI.

A company typically needs money for purchasing assets or maintaining the daily operating expenses. Based on the investment in the business with the future receivable on the company’s balance sheet, a lender decides whether the business is capable of paying back the loan. If a company is new or doesn’t have any assets it’s difficult to borrow.

Considered debt:

- Long-Term Debt

- Current portion of Long-Term Debt

- Notes payable (maturity more than a year)

- Bonds payable

- Drawn line-of-credit

- Notes payable (maturity within a year)

- Capital lease obligations

Not considered debt:

- Accounts payable

- Accrued expenses

- Deferred revenues

- Dividends payable

What is equity?

Equity is own funds or stock or security representing an ownership interest in a company. It’s ownership in an asset — such as a company, property, or car — after your debt on that asset is paid. In case of equity financing, it sells shares of the company to investors in return for capital.

What is Debt-to-equity ratio?

The debt-to-equity ratio measures company’s total debt relative to the amount originally invested by the owners and the earnings that have been retained over time.

Debt to equity ratio calculator

- Total liabilities: Total liabilities represent all of a company’s debt, including short-term and long-term debt, and other liabilities (e.g., bond sinking funds and deferred tax liabilities) i.e. Current liabilities + Non-current liabilities.

- Shareholders’ equity: Shareholders’ equity is calculated by subtracting total liabilities from total assets. Total liabilities and total assets are found on a company’s balance sheet i.e. Common stocks + Preferred stocks.

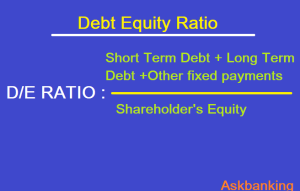

In the numerator, we will take the “total liabilities” of the firm; and in the denominator, we will consider shareholders’ equity. As shareholders’ equity also includes “preferred stock,” we will also consider that.

Debt equity ratio = Total liabilities / Total shareholders’ equity

Negative debt to-equity ratio

If a company has interest rates on its debts that are greater than the return on investment. Negative debt to equity ratio can also be a result of a company that has a negative net worth. Firms that experience a negative debt to equity ratio is risky for lending as well as for investors because this higher debt is a sign of financial instability.

Why to calculate Debt to equity ratio ?

By using the D/E ratio, the investors get to know how a firm or company is doing in capital structure; and how solvent the firm is as a whole. When an investor decides to invest in a company, she needs to know the company’s approach.

The total liabilities are higher than the shareholders’ equity. The investor would think about whether to invest in the company or not; because having too much debt is too risky for a firm in the long run.

If the company’s total liabilities are too low compared to the shareholders’ equity, the investor would also think twice about investing in the company; because then, the company’s capital structure is not conducive enough to achieve financial leverage. However, if the company balances both internal and external finance, the investor might feel that the company is ideal for investment.

What is good debt-to-equity ratio?

In a normal situation, a ratio of 2:1 is considered healthy and good sign of growth.

What if debt to equity ratio less than 1

If the debt equity ratio of the company is less than 1, it means the assets are financed mainly through equity or own funds and having good strength and leverage to its finances. A ratio greater than 1 implies that the majority of its assets are through debt or borrowed money.

Benchmark Debt to equity Ratio

A good debt to equity ratio is around 1 to 1.5. However, the ideal debt to equity ratio will vary depending on the industry because some industries use more debt financing than others. Capital-intensive industries like the financial and manufacturing industries often have higher ratios that can be greater than 2.

A higher debt-equity ratio would mean a higher risk to the money. On the other hand, at a lower D/E ratio, the lenders enjoy a better margin of safety.

Know to calculate the Debt Service Coverage Ratio

Other Financial Ratio :