Know the updated Credit Card Late Payment Charges of Various Banks like ICICI Bank, HDFC Bank, Axis Bank, Citi Bank, SBI Card, Canara Bank, Bank of Baroda, and American Express etc.

Recently many of the banks like ICICI Bank has announced that it has hiked charges of various credit card services like late payment fees. Knowing the late payment fees charged on one’s credit card is important. If you miss a payment, you will be charged a penalty as well as interest on the amount you owe. Further, it will have an impact on your credit score. Late payment fees charged on a credit card will depend on the type of credit card and the amount due.

Here is a look at the credit card late payment fees charges by ICICI Bank, HDFC Bank, Axis Bank, Citi Bank, SBI Card, and American Express.

Topics : -

SBI credit card late payment charges

According to the SBI Card website, late payment charges will be applicable if minimum amount due is not paid by the payment due date. The late payment fee can range from Rs 400 to Rs 1,300.

NIL for Total Amount due from Rs.0-Rs.500; .

Rs. 400 for Total Amount due greater than Rs. 500 & up to Rs. 1000;

Rs. 750 for Total Amount due greater than Rs. 1000 & up to Rs. 10,000;

Rs. 950 for Total Amount due greater than Rs. 10,000 up to Rs. 25,000;

Rs. 1100 for Total Amount due greater than Rs. 25,000 & up to Rs. 50,000

Rs. 1300 for Total Amount due greater than Rs. 50,000

An additional Late Payment Charge of Rs. 100 will be levied on missing payment of Minimum Amount Due (MAD) by the due date for two consecutive cycles. This charge will continue to be levied for every payment cycle until the MAD is cleared.

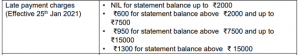

HDFC Bank credit card late payment fees

The payment due date on the credit card statement is the date by which clear funds must be deposited to the credit card; however, three grace days are allowed to account for payment processing time. According to the HDFC Bank website, late payment charges can range from

Rs 100 to Rs 1,300 depending on the amount due.

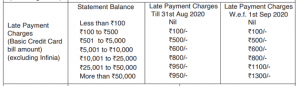

Axis Bank late payment fees

Axis Bank, according to its website, charges between Rs 100 to Rs 1,300 depending on the type of credit card and the amount due. For instance charges on select cards are as follows. Check out more about the charges here.

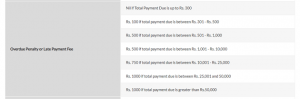

Citibank late payment charges

Citibank credit card customers will be charged between Rs 100 and Rs 1,300 as late payment fees. Late payment charges for Citi Rewards Credit Card 88875619 Late payment charges for Citi Prestige Card.

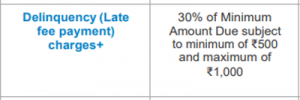

American Express late payment fees

According to the Amex website, a late payment or delinquency fees will be charged as follows: 30% of minimum amount due subject to minimum of Rs 500 and maximum of Rs 1,000.

What if you fail to pay credit card bill on time?

Customers who do not pay their bills on time are worst impacted due to poor credit rating and not able to get any loan from any of the financial institutions in near future. The most significant loss is a tarnished credit history and reduced credit score, both of which reduce your prospects of obtaining credit in the future.

Also Read – Best Credit Card Loan with Lowest Interest Rate 2022

What if you are unable to make payments before due date?

Credit card companies don’t like customers who miss payments. Missing a payment attracts a penalty as well as interest on out standings. The biggest loss is a blemished credit history and lower credit score, which adversely impacts your chances of availing any loan facility in the future.