The current account savings account (CASA) deposit ratio of private sector banks dropped more than that of public sector banks (PSBs) in YOY due to a stronger demand for credit and an increased preference for term deposits by the depositors.

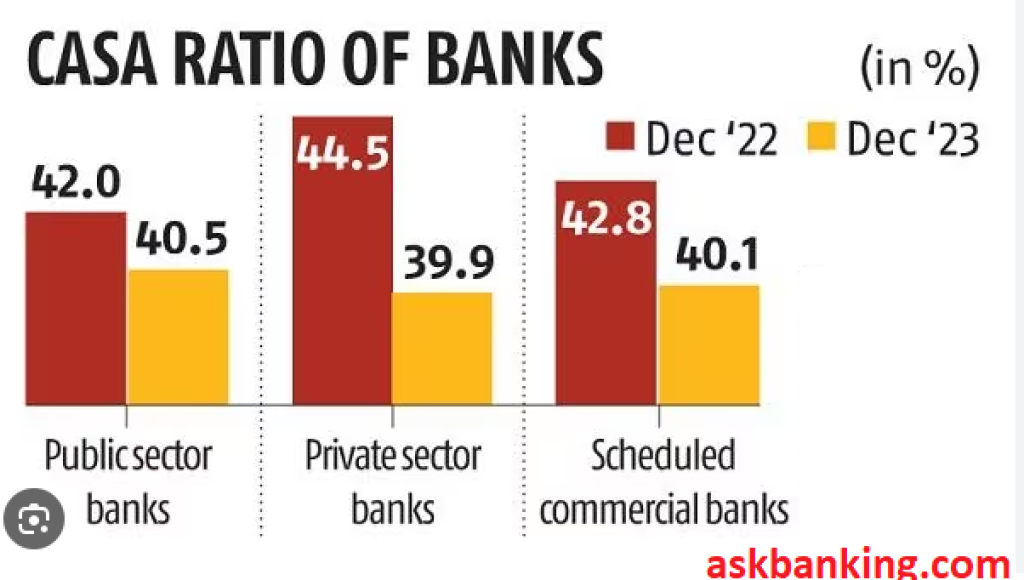

The share of CASA deposits to total deposits of private sector banks contracted to 39.9 per cent at the end of December 31, 2023, compared to 44.5 per cent on December 31, 2022. For PSBs, it slipped to 40.5 per cent from 42 per cent.

The overall CASA ratio of the Indian banking system declined to 40.1 per cent from 42.8 per cent during the same period.

In a recent interaction with Business Standard, K Satyanarayana Raju, managing director and chief executive officer of Canara Bank, said that the bank has started special campaigns for deposits, including CASA, to boost the growth of such deposits. Canara Bank CASA ratio is lowest among all the public sector banks stood at 31.65% where as the average CASA ratio for PSBs are 40.58%.

The CASA Deposit Ratio of Indian banks have been under pressure since the first quarter of 2022-23 because of increased preference for term deposits by customers due to better rates. A higher CASA ratio is important for banks to maintain a lower cost of funds, which, in turn, helps net interest margins.

Also Read – CASA Deposit Drops for Bigger Public Sector Banks

Banks started to offer higher interest rates on term deposits due to increased demand for loans amid liquidity tightness in the system as a result of monetary policy tightening.

According to RBI data, the term deposits in the Indian banking sector were Rs 177.18 trillion as of January 12, 2024.