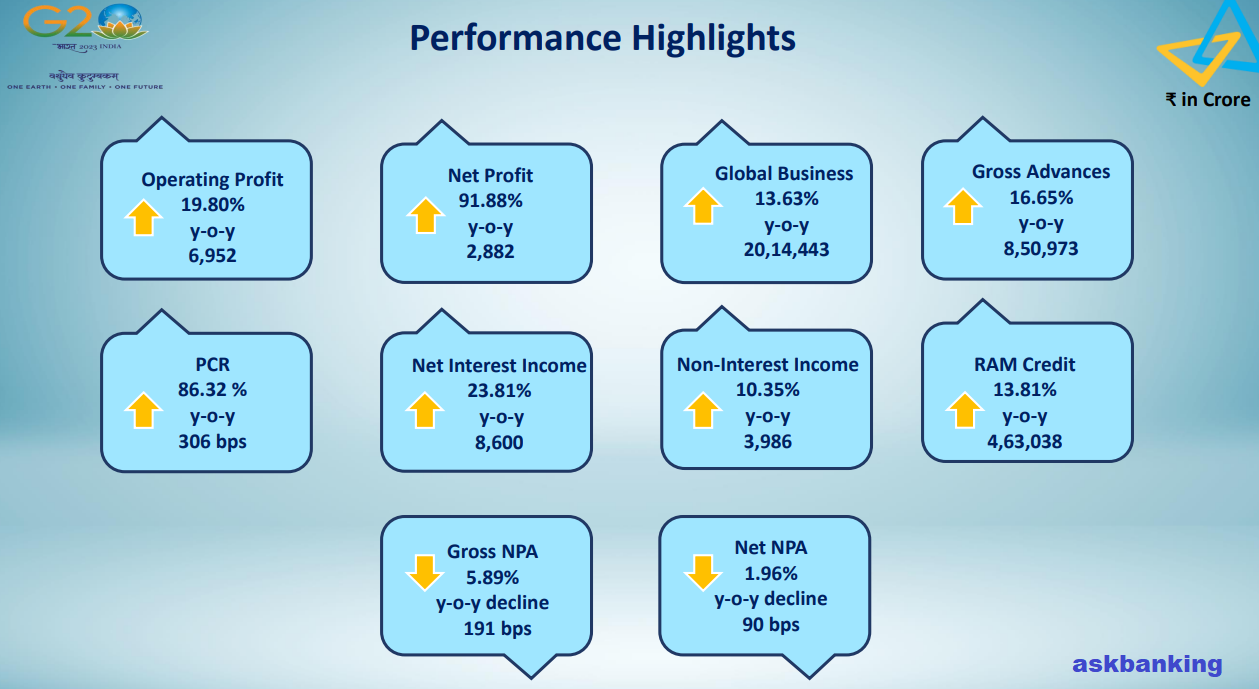

Public Sector Lender Canara Bank Net Profit Jumps by 92% in Q3 as reported by the bank to stock exchange. The net profit increases to almost double during the third quarter ended December 2022 at ₹2,881.5 crore as compared to ₹1,502 crore in the same quarter a year ago. The bank has shown the good numbers in almost all the parameters. The gross non-performing assets (NPAs) declined at 5.89% as against 6.37% in the September 2022 quarter whereas net NPAs dipped to 1.96% from 2.19% from the previous quarter. The asset quality & provisioning is the best in the Banking Industry.

Bank’s net interest income or NII, which is the difference between the interest earned and expended, rose about 24% to ₹8,600 crore as against ₹6,945 crore year-on-year (YoY). Its net interest margin (NIM) stood at 3.04% as compared to 2.83% in the previous quarter.

Due to recovery in the NPA accounts, the bank’s provisions and contingencies declined to ₹3,121 crore from ₹3,636.8 crore quarter-on-quarter (QoQ) and versus ₹2,244.8 crore in the year ago period. Its loan growth stood at 18% (YoY) with Housing loan portfolio by 15% YoY. The capital adequacy ratio rose to 16.72% in December quarter as against 16.51% QoQ and 14.80% YoY.

▶️मुनाफा ₹1,502.1 Cr से बढ़कर ₹2,881.5 Cr (YoY)

▶️NII ₹6,945 Cr से बढ़कर ₹8,599.9 Cr (YoY)

▶️ग्रॉस NPA ₹52,485.1 Cr से घटकर ₹50,142.8 Cr

▶️नेट NPA ₹17,286.1 Cr से घटकर ₹15,981.7 Cr

▶️लोन ग्रोथ 18% (YoY)

Reported by @CNBC

Bank has also started stake in the overseas arm and recently sold its stake in Russian joint venture Commercial Indo Bank LLC (CIBL) to the other venture partner State Bank of India (SBI) for about ₹114 crore. CIBL, incorporated in 2003, is a joint venture (JV) in Russia between SBI (60%) and Canara Bank (40%). Checkout the detailed Investor publication.