Income Tax calculation for FY 2020-21 and AY 2021-22 – Union government has introduced a new income tax strucre along with the existing one. The new income tax regime is optional, and individuals can either opt for the new regime or file their taxes as per the old regime.

Existing tax regime:

There are three categories of individual taxpayers:

- Individuals (below the age of 60 years), which includes residents as well as non-residents

- Resident senior citizens (60 years and above but below the age of 80 years)

- Resident super senior citizens (above 80 years of age)

There are different slabs for each category of taxpayers.

Read – New Income Tax Slab Rate for Financial Year 2020-21

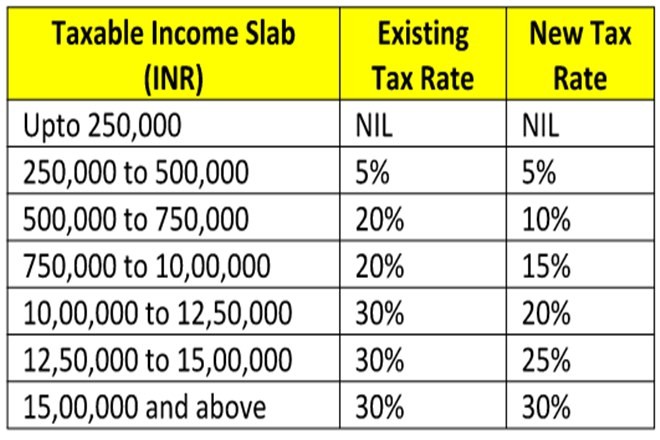

Income tax slabs under the new tax regime for all individuals for FY 2020-21 (AY 2021-22)

| Income Tax Slab | Tax Rate |

|---|---|

| Up to Rs 2.5 lakh | NIL |

| Rs 2.5 lakh to Rs 5 lakh | 5% (Tax rebate of Rs 12,500 available under section 87A) |

| Rs 5 lakh to Rs 7.5 lakh | 10% |

| Rs 7.5 lakh to Rs 10 lakh | 15% |

| Rs 10 lakh to Rs 12.5 lakh | 20% |

| Rs 12.5 lakh to Rs 15 lakh | 25% |

| Rs 15 lakh and above | 30% |

Note : The tax calculated on the basis of such rates will be subject to health and education cess of 4%.

Income Tax Slabs & Rates for Individual Tax Payers & HUF (Less Than 60 Years Old) for FY 2019-20

| Income Tax Slab | Tax Rate for Individual & HUF Below the Age Of 60 Years |

|---|---|

| Up to ₹2,50,000* | Nil |

| ₹2,50,001 to ₹5,00,000 | 5% of total income exceeding ₹2,50,000 |

| ₹5,00,001 to ₹10,00,000 | ₹12,500 + 20% of total income exceeding ₹5,00,000 |

| Above ₹10,00,000 | ₹1,12,500 + 30% of total income exceeding ₹10,00,000 |

Income Tax Slabs for Senior Citizens (60 Years Old Or More but Less than 80 Years Old) for FY 2019-20

Read – 5 Key Changes in Income Tax Provisions Announced in Budget 2019

| Income Tax Slabs | Tax Rate for Senior cetizens aged 60 Years But Less than 80 Years |

|---|---|

| Income up to Rs 3,00,000* | No tax |

| Income from Rs 3,00,000 – Rs 5,00,000 | 5% |

| Income from Rs 5,00,000 – 10,00,000 | 20% |

| Income more than Rs 10,00,000 | 30% |

Income Tax Slabs for Super Senior Citizens(80 Years Old Or More) for FY 2019-20

| Income Tax Slabs | Tax Rate for Super Senior Citizens (Aged 80 Years And Above) |

|---|---|

| Income up to Rs 5,00,000* | No tax |

| Income from Rs 5,00,000 – 10,00,000 | 20% |

| Income more than Rs 10,00,000 | 30% |

How to choose New Tax Regime ?

Read – How to Check Genuineness of e-filing Income Tax Returns ?

As per the Income tax guidelines, any individual opting to be taxed under the new tax regime from FY 2020-21 onwards will have to give up certain exemptions and deductions.

Check out the list of the exemptions and deductions that a taxpayer will have to give up while choosing the new tax regime.

-

-

- Leave Travel Allowance

- House Rent Allowance

- Conveyance

- Daily expenses in the course of employment

- Relocation allowance

- Helper allowance

- Children education allowance

- Other special allowances [Section 10(14)]

- Standard deduction

- Professional tax

- Interest on housing loan (Section 24)

- Chapter VI-A deduction (80C,80D, 80E and so on) (Except Section 80CCD(2) and 80JJA)

Points to remember while opting for the new tax regime:

-

- Option to be exercised on or before the due date of filing return of income for AY 2021-22

-

In case a taxpayer has a business income and exercised the option, he/she can withdraw from the option only once.

-

A business taxpayer withdrawing from the optional tax regime has to follow the regular income tax slabs.

-