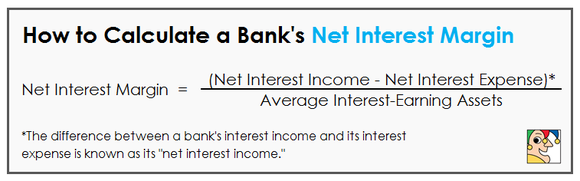

Formula to Calculate Net Interest Margin (NIM) in Percentage, which is the difference of Interest Income generated through various sources and expenses made out on interest to lenders on various items like deposit etc.

How To Calculate Net Interest Margin ?

Net interest margin (NIM) is a measure of the difference between the interest income earned by a bank and the interest it pays out to its lenders (for example, fixed depositors, CASA accounts), relative to the amount of their assets that earn interest. It is similar to the gross margin or gross profit margin of non-banking finance companies (NBFC).

NIM is usually expressed as a percentage of what the financial institution earns on loans in a time period and other assets minus the interest paid on borrowed funds divided by the average amount of the assets on which it earned income in that time period. In other words, it’s what net interest income a lender earns in percentage terms on the average interest-earning assets in a specified period.

For example, if a bank’s average interest-earning assets or in generic term Loan portfolios, which may include loans and investment securities, stood at Rs 1,00,000 in a year and it earned an interest income of Rs 70000 and paid interest expense of Rs 40000, the NIM would be (70000 – 40000) / 10,0000 = 30%.

NIM is important to bank as it gives the average earning on its assets or average interest-earning assets.

Why is NIM important for Banks ?

The NIM is an indicator of profitability that shows the probability of an investment firm or bank thriving over the long haul. This metric helps prospective investors determine whether to invest in a given financial services company or not.